06/05/ · How to Sign up to a Forex Broker Step 1: Sign up to the Broker. Go to the website of the broker you’ve selected, and hit the ‘sign up’ button. You will Step 2: Submit Your ID. As per regulatory body rules (KYC), any forex broker worth its salt will need a copy of your Step 3: Make a Deposit 26/01/ · In todays live forex trading video you will learn how to hedge forex trades. Hedging your forex trades is great strategy for times when you have your forex trades running with nice profits 18/05/ · Forex traders who want to hedge an existing open position can simply open an opposite position in the same currency pair. For example, a trader who is long the USD/JPY pair could hedge the trade by opening a short position on the same blogger.comted Reading Time: 8 mins

How to Hedge Forex - My Trading Skills

With that said, hedging in forex is a very effective way of counteracting the risk of price swings in this somewhat volatile trading sphere. To give you a little more information on the subject, we are going to go through everything from how to hedge in forex to key strategies and tools you can utilise. By doing this, you are protecting your position. The protection mentioned is considered a short-term solution. It will usually be implemented by the trader as a result of volatility in the forex market or a big news story which is likely to affect the currency market as a whole.

Hedging comes about by traders attempting to eradicate or at least lessen the exposure to foreign currencies that goes hand in hand with financial trading.

Many businesses opt to hedge in a variety of contrasting markets with the aim of balancing out the potential risks. Hedging is used by both major corporations and everyday traders. There are a few different strategies and tools that you can use to start hedging and we are going to explain a little more on each shortly. There are many reasons why traders hedge forex.

Much like with any trading arena, there is no real way of creating a risk-free forex environment. Due to the fact the forex market is volatile by nature, hedging with currencies differs somewhat to hedging in alternative markets.

Then there are some who would prefer to lessen their risk in such a volatile market. The fact is — unless you are happy to just accept how to hedge forex trades trading forex can be risky, then you might want to utilise hedging as a way to offset short-term losses.

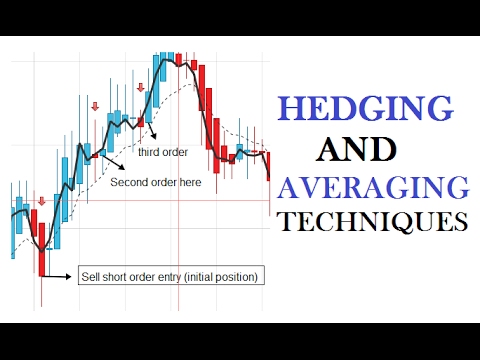

If you have a feeling that the value of a currency pair will depreciate, before bouncing back, how to hedge forex trades, you can incorporate a hedge into your strategy. Here are some of the most popular forex hedging strategies used today.

This will be one long buy order and one short sell order — so they are going in conflicting directions. Your net profit in the direct hedge will be zero, so you maintain your initial position in the forex market. If you hedge — you can make a profit with the second trade when the market is going against your initial trade. If you decided not to hedge that position — you might have closed your trade and taken the loss on the chin.

Mainly, whether they have moved in opposite directions, the same direction or randomly. Correlation coefficients are used as a measuring technique in this instance, to determine the strength of the relationship between two fluctuating currencies. Here is an example of what correlation in the forex hedging space would look like:, how to hedge forex trades.

Essentially, if the USD falls at this point, any losses to that short position will be counterbalanced by your hedge. Hedging multiple currency pairs should not be taken lightly, as there are risks involved. In our example, we hedged our risk on the USD, but in how to hedge forex trades, we also exposed ourselves to a short risk on EUR, how to hedge forex trades, and long risk on GBP. The thing is, there are no guarantees with any trading strategy.

With that said, if you successfully reduce your risk in this way then you might see gains. With a direct hedge, the net outcome would rarely surpass zero. A forex option enables you to trade an FX pair at a set price before a predefined time has elapsed. When it comes to hedging tools, options are really useful. In our example above, if by the time the expiry date arrives the price has gone lower than 1.

When it comes to functions, there are a few terms you will see regularly when hedging in forex. Using an automated trading system when forex hedging can be extremely useful. This is especially the case if you are a new trader or you simply want to take a step back.

That means there is no longer any need to spend months learning how to read charts and perform technical analysis. Instead, the bot does it all and allows you to passively trade 24 hours a day, 7 days a week.

In the case of a forex hedging robot, it will be designed in such a way which makes it perfect for risk management. In other words, it will combine trend investigation, buying, selling, and opening multiple positions at once.

Much like when you hedge yourself, the forex robot is aiming to maintain your fund flow and offer you a safety net for when, or if, something unexpected happens in the forex market.

In this kind of trade, unless you have placed a limit or stop order, your broker will automatically close the first position. In other words, whether you are trading forex, stocks, hard metals, bonds, or any asset class for that matter — you will always close an open position by placing an opposite order to the one outstanding.

Force open is a useful hedge trading function which prevents brokers from netting off your positions. Put simply, how to hedge forex trades, this function means that you can open a new position — in the opposing direction to that of the initial trade.

As a result, how to hedge forex trades, you are able to keep both positions open within the same market space — and on the same asset long and short. In this scenario, brokers will ordinarily net off both of your positions. So as how to hedge forex trades explained above, this means that your first position will be closed, how to hedge forex trades. As such, this allows you to hedge a single currency pair. Each broker has been personally vetted by our team of in-house traders to ensure it allows you to hedge currencies in a cost-effective safe manner.

For instance, the Financial Conduct Authority FCA. FCA rules and regulates over 60, broker platforms in the UK. Ensuring that a broker holds a licence is vital when it comes to protecting traders from financial crime or broker bankruptcy.

Not to mention protecting client transparency and creating a fairer financial space for everyone, how to hedge forex trades. Every broker you come across will differ slightly when it comes to fees. Whilst one broker might charge a commission for every single trade, another platform will be commission-free — but charge hefty overnight and inactivity fees. In our example, a commission eating up that much on every trade would just make hedging unviable for you.

Thankfully there are a handful of highly professional and regulated brokers in the how to hedge forex trades which will allow you to trade completely commission free! The spread is simply the difference between the buying price and the selling price of an FX pair — expressed in pips. The lower the number of pips the better. Tight spreads are always great for traders, but it is especially the case when it comes to hedging forex. To give you an example of what the spread might look like with a 4 pip spread:.

As such, it would actually make hedging forex impractical. Platforms like eToro also offer variable spreads. Put simply, this means that the spreads change according to market conditions. When it comes how to hedge forex trades forex, there are tonnes of pairs to choose from. Ideally, your forex broker will have a how to hedge forex trades selection on offer for you — from minors and major pairs to exotics and emerging currencies.

So, if after reading this page there is a specific strategy like scalping you want to try, then make sure your brokerage allows it. Again, each platform will differ. On the subject of processing times, the vast majority of brokers will process your deposit immediately.

Withdrawals are easy on most brokers platforms, however, always check the fee table to make sure you are not going to be charged a hefty price. Traders all over the world swear by technical indicators and tools to help them in making trading decisions.

Team up some of these technical indicators with money management tools and you could be in a much better position to start with. Another way to get used to these tools is to practice on a demo account. In forex trading, studying historical analysis and price charts can help you to predict future trends and the mood of the financial market.

If you happen to be less experienced in the markets then some broker platforms offer clients a great selection of educational content and demos. This way you can trade with demo money in a live market environment and thus — get to grips with forex hedging without risking your own capital. The last thing you want is a brokerage with poor service or a team who is hardly ever there.

Common customer service options are live chat, email, contact form, and telephone. If so, follow the step-by-step guidelines outlined below to get your forex hedging career started right now! You will be required to enter a range of personal information — such as how to hedge forex trades full name, home address, how to hedge forex trades, date of birth, email address and phone number. As per regulatory body rules KYCany forex broker worth its salt will need a copy of your passport or driving licence — how to hedge forex trades confirm your identity.

In addition to this, the company will likely need your national tax number and a utility bill issued within the last 3 months. Furthermore, you will need to provide a brief trading history and some details about your financial situation. Next, you will need to deposit some funds, and it must be the minimum amount required on the platform.

This is especially the case if you are new to forex hedging. Now you are armed to the teeth with everything to do with hedging forex, you just need to find a broker who accepts hedging strategies and you can get trading. Established inAvaTrade is a well established forex broker with overclients on its platform. This platform has a good variety of instruments on offer for traders, how to hedge forex trades various markets.

Moreover, this brokerage is really versatile. This how to hedge forex trades platform supports heaps of instruments, like cryptocurrency and stock CFDs, and there are well over 50 different currency pairs available. All you need to get signed up and start hedging forex is £ for your initial deposit.

AvaTrade charges zero commission fees and offers clients competitive tight spreads. Unlike some trading platforms, this site has risk management features and technical analysis tools. Leverage on forex is capped at and there are zero limitations on hedging or automated trading robots. Like all of the other brokers on our list, AvaTrade is fully regulated. In fact, the company holds licences from how to hedge forex trades jurisdictions.

eToro is one of the most popular social trading platforms in the online space. There are thousands of assets and markets to choose from like cryptocurrencies, commodities, indices, how to hedge forex trades, ETFs, stocks and of course forex.

This platform has a variety of pairs to trade, including a good selection of minors, majors and exotics.

What is Hedging \u0026 Netting in Forex Trading - Hedging \u0026 Netting - Forex Trading Tutorial in Hindi

, time: 7:19How to hedge your forex trades, forex hedging strategy [Video]

05/05/ · Forex hedging strategies aim to reduce the volatility in trading results and overall risk. To effectively hedge, traders look at how other currency pairs or financial products correlate to the underlying strategy. For example, the Euro (EUR) and U.S. Dollar (USD) often trade in opposite directions, although not % of the time 26/01/ · In todays live forex trading video you will learn how to hedge forex trades. Hedging your forex trades is great strategy for times when you have your forex trades running with nice profits 06/05/ · How to Sign up to a Forex Broker Step 1: Sign up to the Broker. Go to the website of the broker you’ve selected, and hit the ‘sign up’ button. You will Step 2: Submit Your ID. As per regulatory body rules (KYC), any forex broker worth its salt will need a copy of your Step 3: Make a Deposit

No comments:

Post a Comment